March 13, 2023

If you registered a US corporation and some of the shareholders are foreign persons, you need to be aware of additional tax reporting responsibilities to avoid potentially costly mistakes.

Withholding

A corporation with foreign shareholders could be responsible for complying with the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) and NRA Withholding.

FIRPTA

A domestic corporation must withhold a tax equal to 10% of the fair market value of the property distributed to a foreign person if:

The shareholder’s interest in the corporation is a U.S. real property interest, and the property distributed is either in the redemption of stock or in the liquidation of the corporation.

NRA Withholding

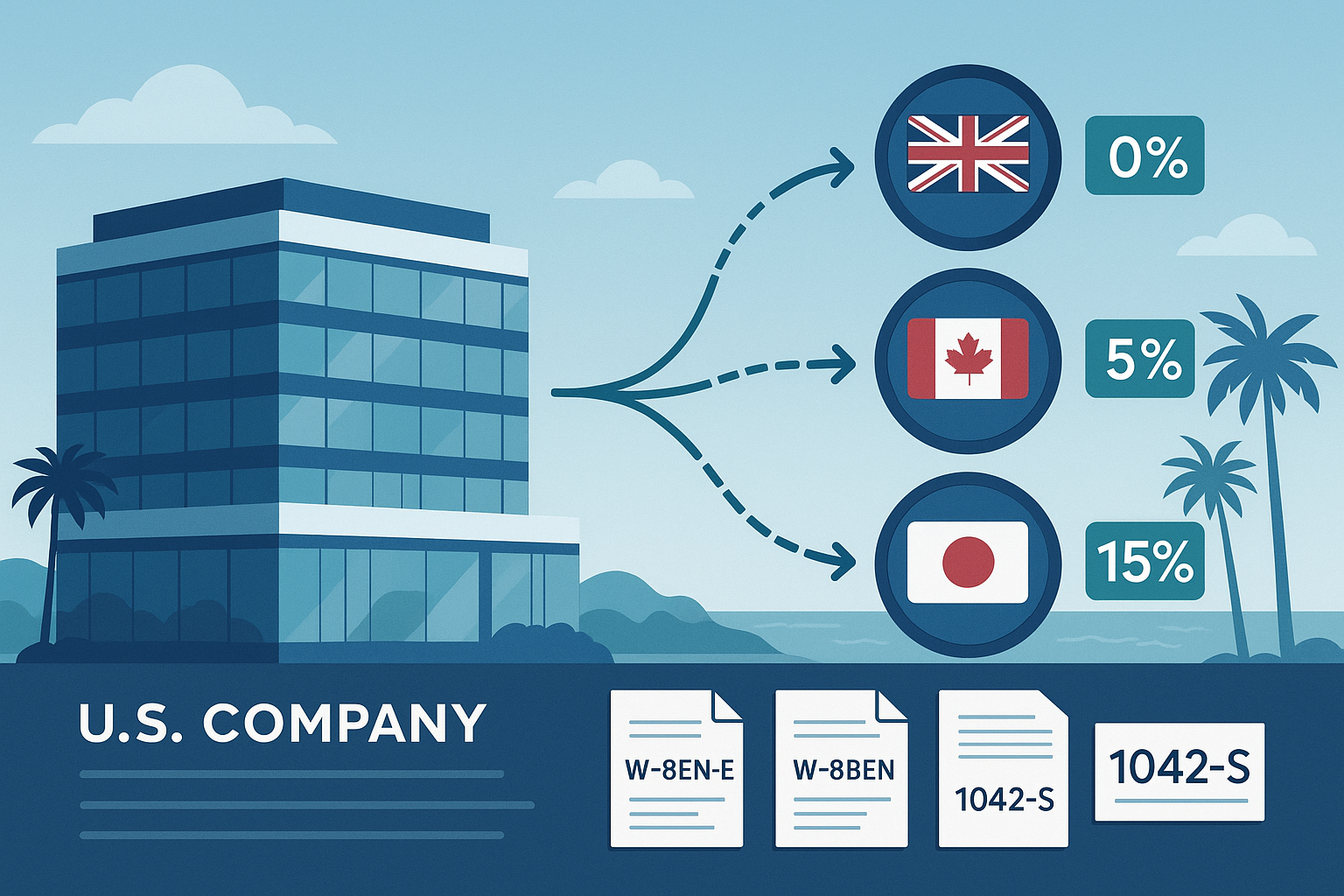

A US corporation generally must withhold 30% on a payment of U.S. dividends to foreign shareholders.

(Refer to Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons and Form(s) 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding)

Additional Reporting Requirements

In addition to the filing of Form 1020, U.S. Corporation Income Tax Return, a corporation with foreign shareholders could be responsible for complying with other filing requirements such as information required under sections 6038A and 6038C when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic-related party.

A corporation generally must file form 5472 if it is a 25% foreign-owned U.S. corporation (including a foreign-owned U.S. disregarded entity (DE)) and has reportable transactions with a related party.

A penalty of $25,000 will be assessed on any reporting corporation that fails to file Form 5472 when due and in the manner prescribed. The penalty also applies for failure to maintain records as required.

Share this post :

Categories