August 12, 2025

If you’re a U.S., San Diego, or Carlsbad business owner, expat, or investor with ownership in a non-U.S. corporation, Form 5471 is the IRS information return that most often gets missed, and the penalties are severe. The form isn’t a tax by itself; it’s a disclosure. But if you should file and don’t, the IRS can hit you with $10,000 per corporation per year, plus continuation penalties up to $50,000 and potential reductions of foreign tax credits.

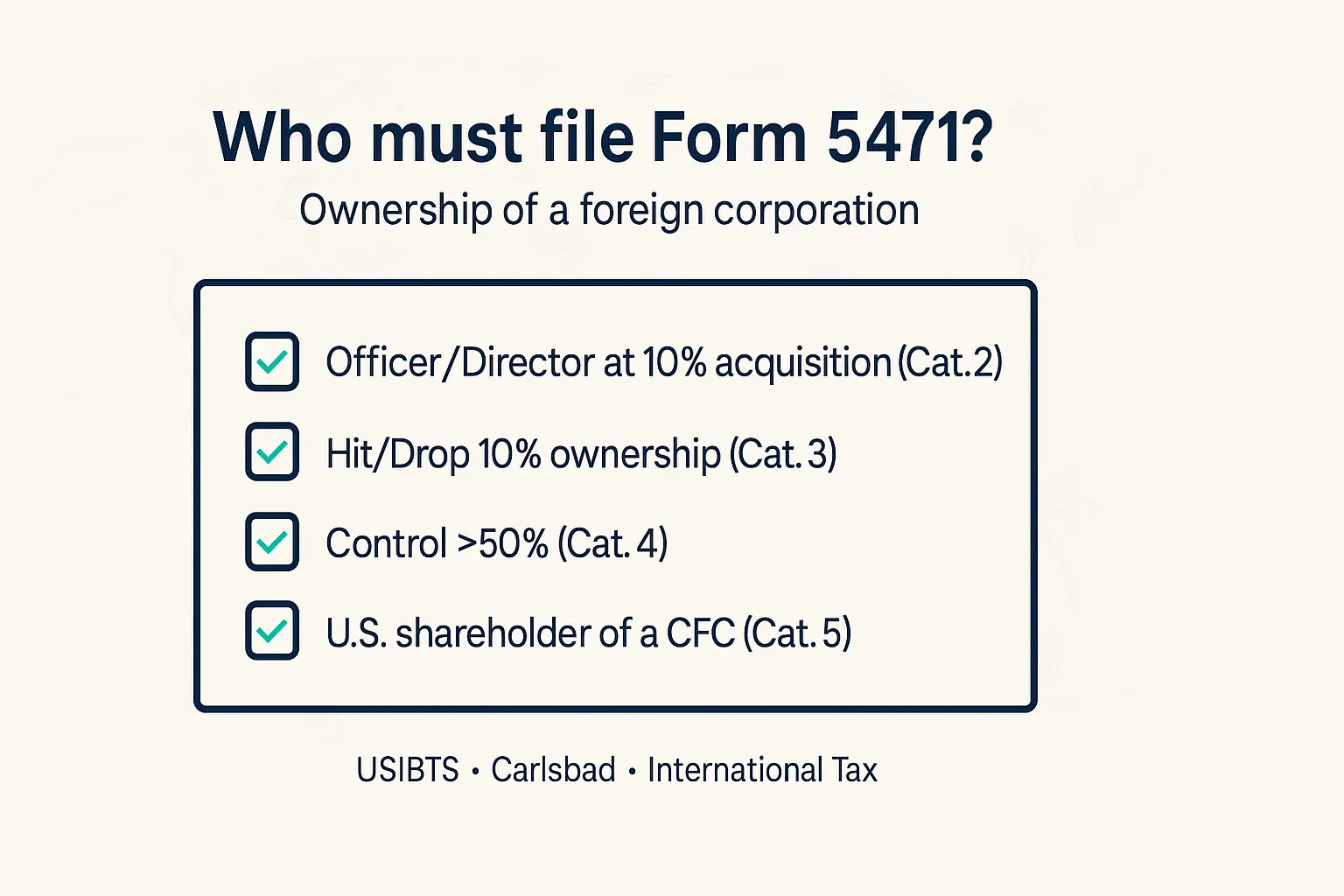

Who must file Form 5471? (simple checklist)

- You’re a U.S. officer or director of a foreign corporation when a U.S. person acquires at least 10% of the company. (Category 2)

- You’re a U.S. person who hits the 10% ownership threshold, acquires an additional 10%, drops below 10%, or becomes a U.S. person while at 10%. (Category 3)

- You’re a U.S. person who controls the foreign corporation (more than 50% vote or value) at any time during the year. (Category 4)

- You’re a U.S. shareholder (generally ≥10%) of a controlled foreign corporation (CFC) at any time during the CFC’s year and you owned stock on the last day it was a CFC (Category 5; includes subcategories 5a/5b/5c and certain exceptions).

- Less common: You were a U.S. shareholder of a section 965 “specified foreign corporation” during the transition tax period (Category 1).

Penalties (why this matters)

Failing to file or filing incomplete/late can trigger a $10,000 penalty per foreign corporation, plus $10,000 for each 30 days after IRS notice (max $50,000). In some cases, foreign tax credits can be reduced. Reasonable-cause relief may apply, but don’t bank on it.

Local help in San Diego

USIBTS (based in Carlsbad, CA) helps U.S. and San Diego shareholders of foreign companies, new immigrants, and expats figure out if Form 5471 applies, which category(s) you’re in, and which schedules you need without over-filing.

Own shares abroad and unsure? Contact us for consultation and tax return preparation.

Share this post :

Categories