September 4, 2025

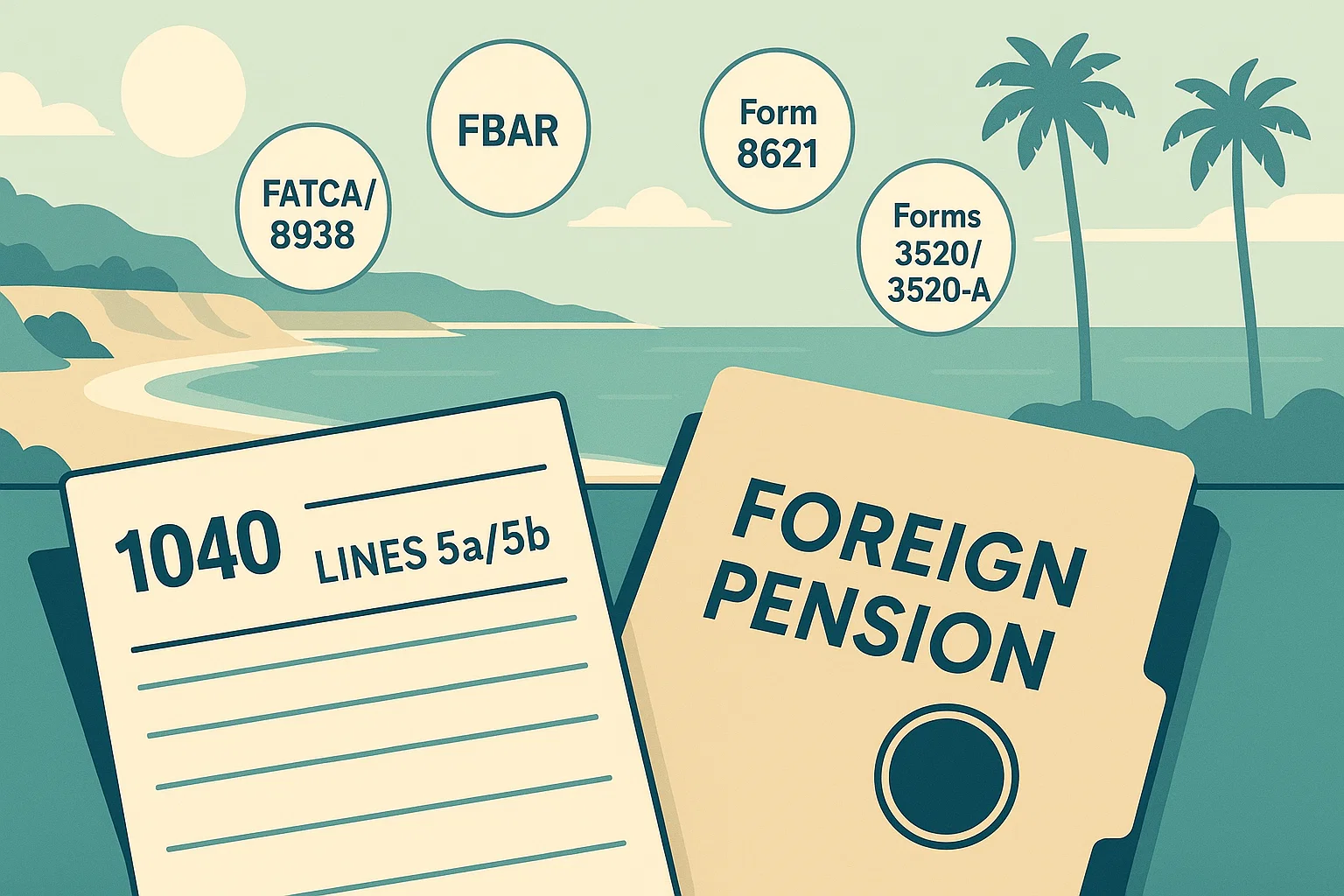

If you’re a U.S. citizen, green-card holder, or long-term resident in Carlsbad, San Diego, or anywhere in U.S., the IRS expects you to report worldwide income, including foreign pension distributions. Those payouts go on Form 1040, lines 5a (gross) and 5b (taxable), just like a U.S. pension. The IRS even notes that distributions from foreign pension plans belong on those lines, and in some cases, undistributed income may be taxable too.

Treaty provisions (e.g., with Canada, the U.K., etc.) can change taxation or deferral, but reporting duties often still apply. The safest path is to (1) include distributions on 1040 lines 5a/5b, (2) evaluate Form 8938/FBAR thresholds, and (3) confirm whether 3520/3520-A or a treaty affects your situation.

Beyond income reporting, you may also have information reporting duties:

-

📌FATCA (Form 8938). If your interest in a foreign pension/retirement account (or other specified foreign financial assets) exceeds the relevant threshold, you may need Form 8938 with your tax return. If the same asset is fully reported on Forms 3520/3520-A, 5471, 8621, or 8865, you generally disclose that fact in Part IV of Form 8938 instead of duplicating details. Penalties for failing to file start at $10,000 and can reach $50,000 for continued non-filing.

-

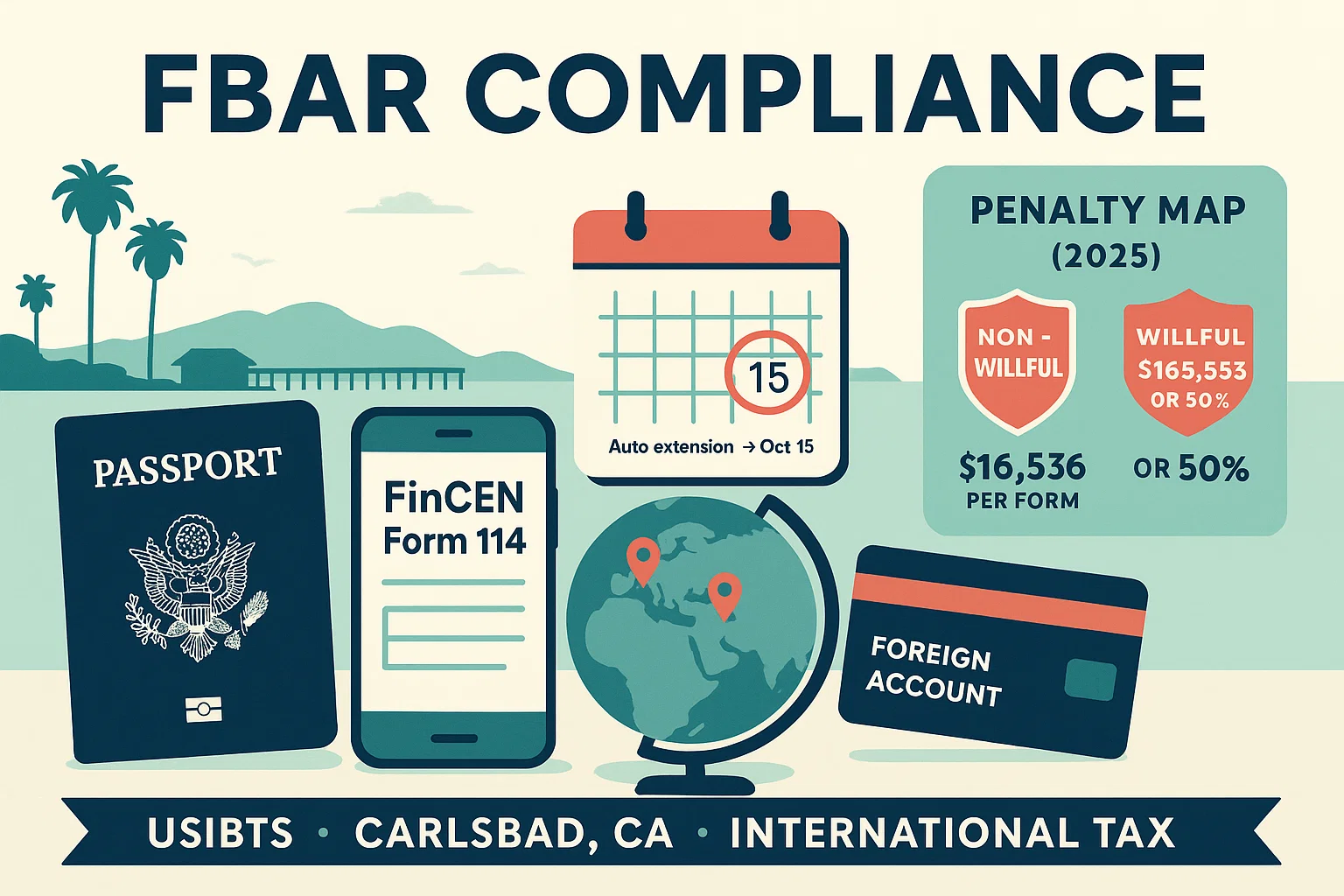

📌FBAR (FinCEN Form 114). If you have a financial interest in or signature authority over foreign financial accounts whose aggregate value exceeded $10,000 at any point in the year, you must e-file an FBAR (due April 15 with an automatic extension to October 15). Whether a foreign pension is FBAR-reportable depends on the plan’s structure—FBAR is triggered by accounts, not the mere existence of a plan.

-

📌Foreign trust rules (Forms 3520/3520-A). Some foreign pensions are trusts for U.S. tax purposes. However, Rev. Proc. 2020-17 exempts many tax-favored foreign retirement trusts from reporting. It is welcome relief if your plan meets the criteria. Always verify whether your plan qualifies.

-

📌Form 8621. If your foreign pension (or a fund held inside it) owns shares of a passive foreign investment company (PFIC), often the case with foreign mutual funds or unit trusts, you may have a Form 8621 filing duty. A PFIC is any foreign corporation meeting the 75% passive-income or 50% passive-asset test.

Based in Carlsbad, serving San Diego County and beyond. If you’re an expat returning to Encinitas, a biotech pro with a U.K. pension in San Diego, or a cross-border entrepreneur in San Francisco, we’ll map out the correct filings before penalties become a problem.

Contact us for a consultation.

Share this post :

Categories