August 5, 2025

If you’ve lived outside the U.S. and missed reporting a foreign bank account, investment income, or pension, don’t worry; there’s a solution. The IRS created the Streamlined Foreign Offshore Procedures (SFOP) for U.S. taxpayers residing abroad who unintentionally failed to comply with foreign asset reporting requirements.

Whether you’re a San Diego native now living overseas or a U.S. expat with offshore investments, SFOP can help you clean up past non-compliance without penalties.

📄 What Can You Fix Through SFOP?

SFOP allows you to catch up on key international tax filings:

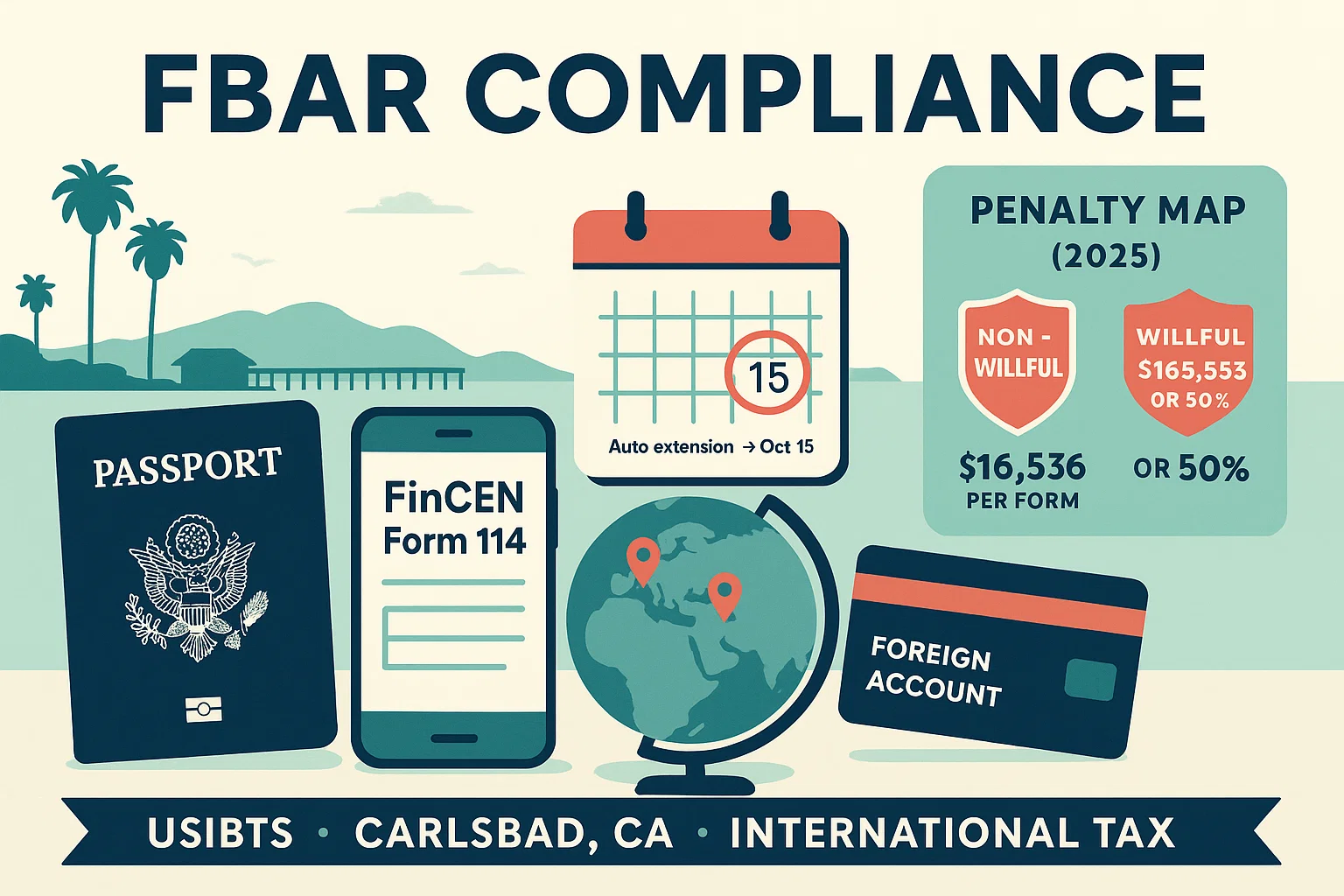

- FBARs (FinCEN Form 114) for the past 6 years

- Amended or late tax returns (Form 1040 or 1040-X) for the past 3 years

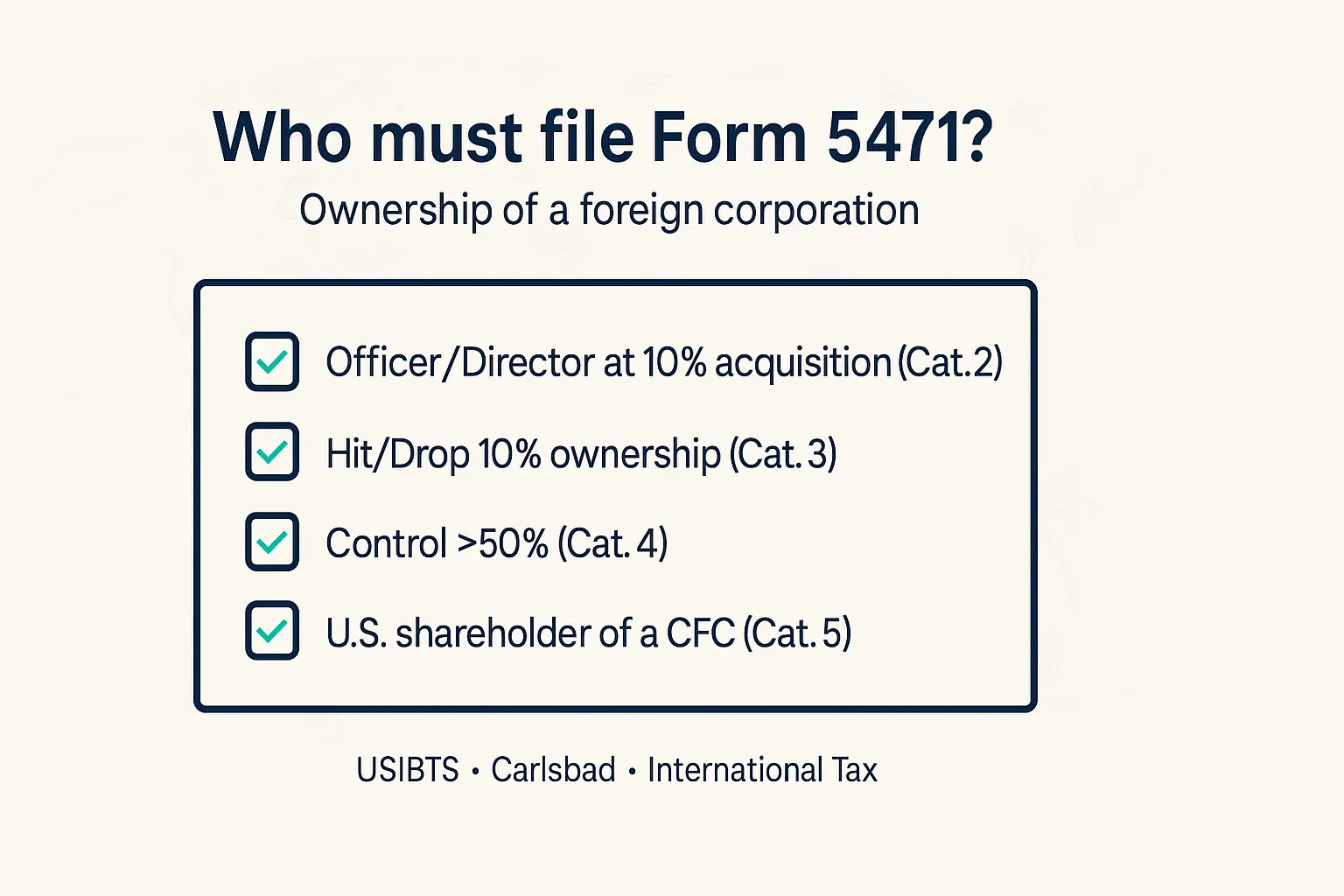

- International forms such as 8938, 5471, 3520, and 8621

✅ Are You Eligible?

- You qualify for SFOP if:

- You’re a U.S. citizen, Green Card holder, or tax resident

- You meet the IRS’s non-residency test for the Streamlined program

- Your failure to report was non-willful, caused by a misunderstanding or oversight

- You’re not currently under IRS audit or investigation

💡 Key Benefits

- No IRS penalties (including no FBAR or offshore asset penalties)

- Avoid civil and criminal consequences for past non-compliance

- A clean slate—bring your foreign finances into full U.S. tax compliance

🛠 How It Works

- File or amend 3 years of U.S. tax returns

- Submit up to 6 years of FBARs

- Sign and submit Form 14653, certifying non-willfulness and foreign residence

- Pay any owed tax and interest (no penalties)

Local Expertise for Global Tax Issues

At USIBTS in Carlsbad, we help expats and globally connected clients across San Diego County navigate complex IRS procedures like SFOP. We make it easy to get compliant, with no penalty surprises.

Contact us for a consultation.

Share this post :

Categories