August 19, 2025

If you’re a U.S. person in San Diego with money abroad – bank accounts, brokerage accounts, even certain foreign pensions – you may need to file the FBAR (FinCEN Form 114). You must file when the aggregate value of your foreign accounts exceeds $10,000 at any time during the calendar year. FBAR is filed electronically through FinCEN’s BSA E-Filing system.

When is FBAR due?

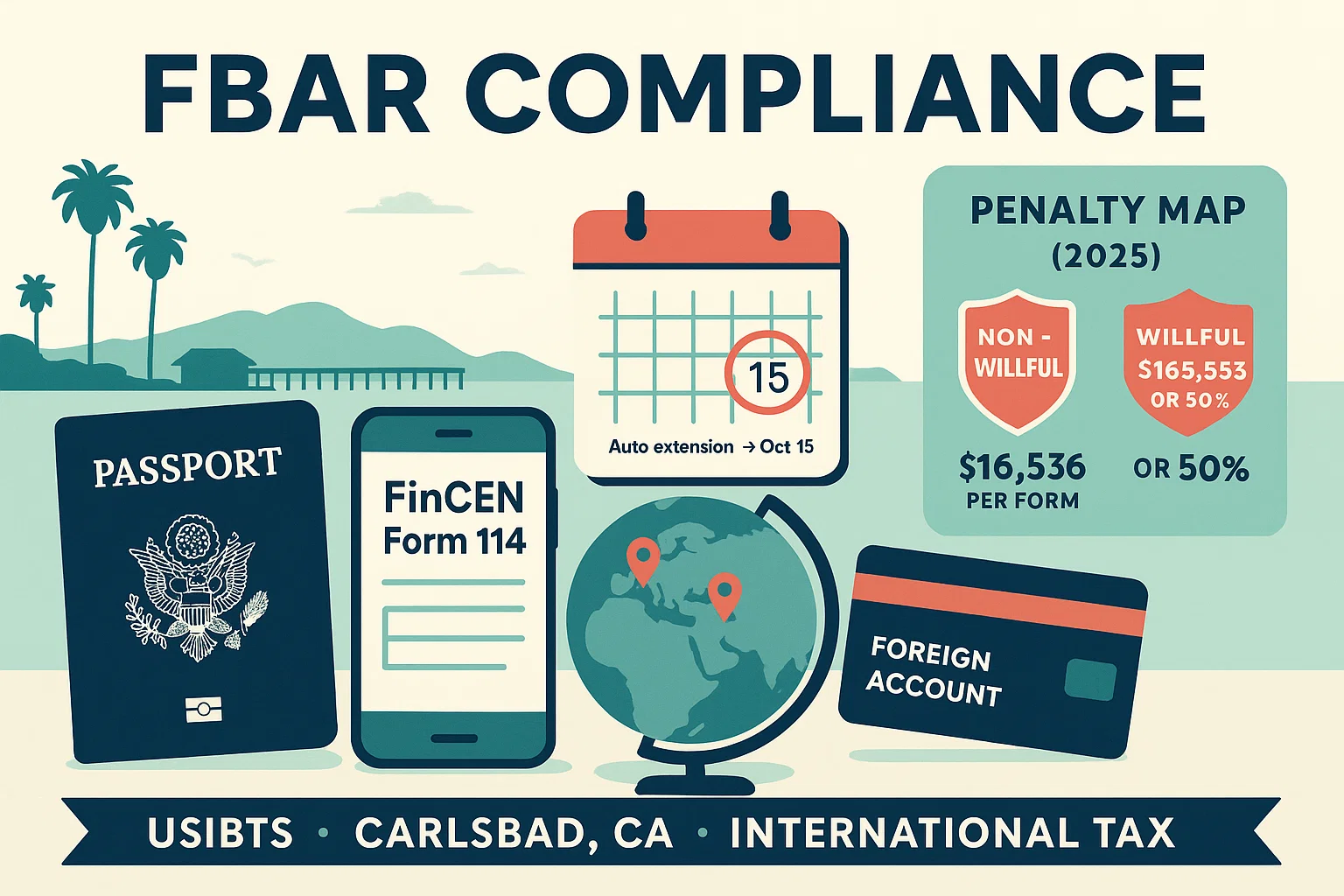

The annual due date is April 15, with an automatic extension to October 15; no separate request is needed.

What happens if you don’t file?

Penalties depend on facts and intent. For non-willful violations, the 2025 inflation-adjusted maximum is $16,536 per violation. For willful violations, the maximum is the greater of $165,353 or 50% of the account balance at the time of the violation.

Importantly, the U.S. Supreme Court ruled that non-willful FBAR penalties apply per form, not per account. It is a significant change that can dramatically reduce exposure for late or incomplete filings.

Missed FBAR🆘? Your options in U.S./Carlsbad/San Diego:

- 📌Delinquent FBAR Submission Procedures (DFSP): If all income from your foreign accounts was properly reported and tax paid, and the IRS hasn’t contacted you, you can file late FBARs and the IRS will not impose a penalty.

- 📌Streamlined Filing Compliance Procedures: For non-willful cases involving unreported income, Streamlined can help you get compliant (generally 3 years of returns + 6 years of FBARs).

Bottom line for U.S. residents, citizens, and expats: Don’t wait for an IRS or FinCEN letter. Filing now often limits penalties and keeps your banking and travel stress-free.

✅USIBTS✅ Your local international tax team in Carlsbad, CA. We help clients resolve late FBARs, prepare Streamlined submissions, and prevent future issues.

Contact us for a consultation.

Share this post :

Categories