Blog

How to Report Foreign Rental Property on Your U.S. Tax Return

Own a condo in Baja, a flat in London, or an apartment in Tel Aviv but file taxes in San Diego County? The IRS expects you to report worldwide rental

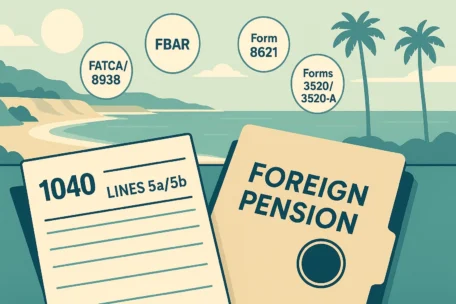

Reporting Foreign Pensions: What the IRS Wants to See

If you’re a U.S. citizen, green-card holder, or long-term resident in Carlsbad, San Diego, or anywhere in U.S., the IRS expects you to report

Foreign-Owned U.S. LLC? Why You May Need to File Form 5472

If you’re a foreign investor who formed a U.S single-member LLC treated as a disregarded entity, there’s a good chance the IRS expects an annual

What Is FBAR and What Happens If You Don’t File It?

If you’re a U.S. person in San Diego with money abroad - bank accounts, brokerage accounts, even certain foreign pensions - you may need to file

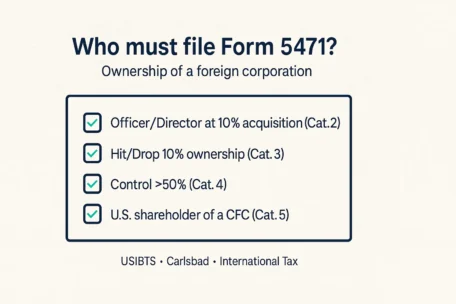

Got shares in a foreign company? Here’s how to know if Form 5471 is on your to-do list.

If you’re a U.S., San Diego, or Carlsbad business owner, expat, or investor with ownership in a non-U.S. corporation, Form 5471 is the IRS

Streamlined Foreign Offshore Procedures: Fixing Past Foreign Reporting Failures

If you’ve lived outside the U.S. and missed reporting a foreign bank account, investment income, or pension, don’t worry; there’s a solution.