February 3, 2024

What is a CPA?

Certified Public Accountant, is an accounting professional who earns this title by meeting state licensing requirements, completing educational training, gaining experience, and successfully passing the CPA Exam.

Roles of a CPA

Contrary to a job title, a CPA is a professional designation offering flexibility and mobility. Initially licensed in one state, CPAs can expand their reach to additional states through reciprocity laws.

Diverse Opportunities

CPAs are valued for reliability, industry knowledge, and credentials across various industries. They can work in public accounting, business, government, education, and non-profit sectors, among others, opening doors to opportunities in nearly every industry and showcasing their expertise in various CPA services.

What Does a CPA Do?

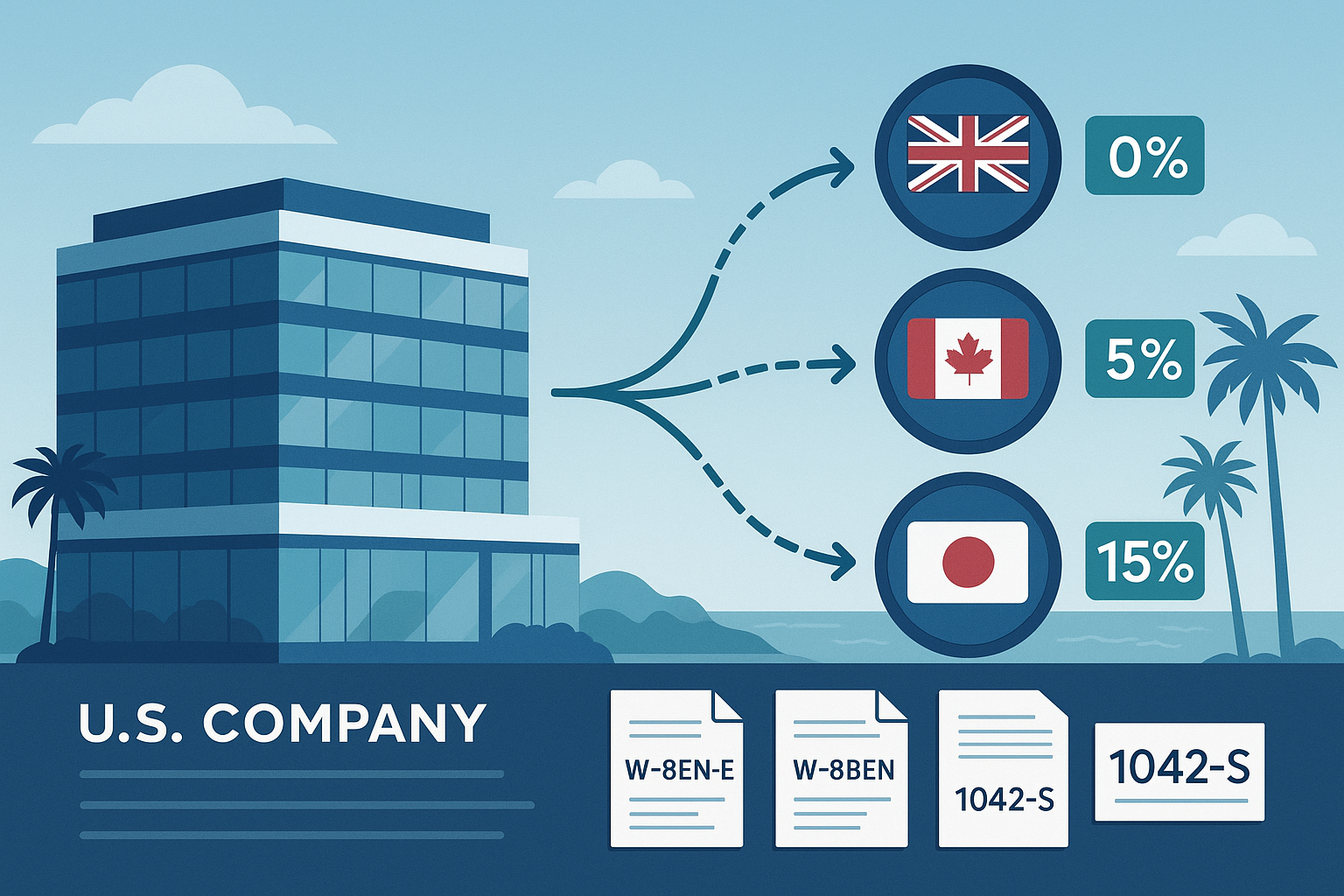

While all CPAs are accountants, not all accountants are CPAs. With exam preparation and continuing professional education, CPAs offer specialized services in areas such as tax accounting, bookkeeping, auditing, tax preparation, tax consulting, financial planning, and litigation consulting.

How to Become a CPA?

Acquiring a CPA license demands time, patience, and strategic planning. Beyond passing the CPA Exam, CPAs commit to 40 hours of continuing professional education (CPE) each year, making the CPA license prestigious in the finance and accounting fields.

Reasons to Pursue CPA Licensure

Why aspire to become a CPA? The National Association of State Boards of Accountancy (NASBA) lists five compelling reasons: prestige and respect, career development, job security, job satisfaction, and financial benefits.

Navigating the Path to CPA Designation

The journey involves the “4 E’s”: Education (150 credit hours in accounting courses), Experience (supervised work under a licensed CPA), Exam (comprising core and discipline sections), and Ethics (required in some states for licensure).

FAQs about CPA

What does CPA stand for in accounting?

CPA stands for Certified Public Accountant.

What is a CPA’s responsibility?

A CPA is more than a job title; it aids in career development across various sectors.

What is a CPA license?

It attests to meeting the profession’s highest standards, as set by the state’s board of accountancy.

Where to find the state’s CPA requirements?

Check with your state’s board of accountancy for unique CPA exams and licensure requirements.

How to apply to become a CPA?

Once you meet state requirements, apply to take the CPA Exam. Learn more about the application process and required documents.

Share this post :

Categories