July 31, 2024

Understanding the importance of addressing back taxes

It is crucial for individuals facing financial difficulties to address back taxes. Failure to do so can lead to heavy consequences such as bank levies, wage garnishments, and accruing additional penalties and interest over time. It’s essential to take proactive steps to address overdue taxes to prevent further financial hardship and to avoid potential legal action by the IRS.

Dealing with delinquent taxes can be managed through several options. Taxpayers can consider setting up a payment plan, requesting a hardship determination, or potentially qualifying for an Offer in Compromise. Addressing back taxes can prevent worsening financial issues and help individuals resolve their tax liabilities effectively.

To stay on top of your tax situation, it’s crucial to regularly monitor your tax account on IRS.gov, review your file for a federal tax return, and reach out to the IRS for additional information when necessary. Taking a proactive approach and addressing taxes on time can help individuals sidestep the stress and financial strain of unresolved tax obligations.

Responding to IRS notices on time

Reviewing the notice and assessing the amount owed

Receiving a notice from the IRS regarding back taxes can be a stressful experience. It’s crucial to respond without delay and take the appropriate steps to resolve the matter. Typically, the IRS will inform you by mail if you owe taxes.

To determine the amount you owe and why, log in to your tax account on IRS.gov. This will allow you to access your tax records, view payments, and see a breakdown of your tax liability by year. Reviewing and amending previous federal tax returns can help clarify any outstanding tax obligations.

In some cases, the IRS backlog of unprocessed returns may have caused delays in accurately determining the amount owed.

If you receive a reminder letter from the IRS regarding unpaid taxes, it is important to address the issue swiftly. Taxpayers have options for reducing or eliminating penalties for late filing or payment of taxes, such as applying for relief under reasonable cause criteria or the First-Time Abate program. Making practical and effective use of online tools and payment options provided by the IRS can help taxpayers set up payment plans and avoid additional interest and penalties.

Seeking professional tax help if needed

When facing tax disputes with the IRS, it is important to consider seeking professional tax help if needed. A tax lawyer, certified public accountant (CPA), or enrolled agent can offer valuable assistance and support in navigating the resolution process.

A tax professional can review audit notices or correspondence from the IRS. They can explain how to prepare for interviews and identify any red flags on current-year returns that may trigger further scrutiny. They can also assist in understanding taxpayer rights and obligations during an IRS audit.

Exploring available payment plans

When it comes to owing taxes to the IRS but not being able to pay the balance in full, taxpayers have several available options. One of the most common solutions is setting up a payment plan, an installment agreement, through the IRS Online Payment Agreement tool. This tool allows individuals and businesses to choose from different payment plan options based on the amount owed and tax filing compliance.

For individuals, there are two main options available. The first is a long-term payment plan and the second option is a short-term payment plan.

Long-term installment agreement

If you’re unable to pay your full tax debt right away, you can opt for a long-term installment payment arrangement. This allows you to make monthly payments over an extended period. It lets taxpayers pay off their tax balance for several months or even years, depending on the amount owed.

To qualify for a long-term installment plan, taxpayers must meet certain criteria, such as being current with their tax filings and owing a certain amount of debt. The IRS will review the taxpayer’s financial situation to determine the appropriate monthly payment amount based on their ability to pay.

Setting up a long-term payment plan is easy and can be done online through the IRS website. There is no need to call, write, or visit the IRS in person. However, setup fees may apply for some types of plans.

Taxpayers can prevent the accumulation of extra interest and penalties by opting for a long-term installment agreement. This option provides a structured way for taxpayers to pay off their amount due while avoiding more serious consequences, such as tax liens or levies.

Short-term installment agreement

It allows taxpayers to pay off their amount due within 180 days or less. This option is available for individual taxpayers who owe less than $100,000 in combined tax, penalties, and interest. It provides a flexible and manageable way to settle tax liabilities without immediate financial strain.

To set up a short-term plan, taxpayers can apply online at IRS.gov. This convenient option lets you set up quickly and easily without waiting for a tax bill. The amount owed must be within the specified limits to qualify for this plan.

By choosing this agreement, taxpayers can avoid potential collection enforcement actions and penalties. This option offers a practical and effective solution for individuals looking to address their tax obligations on time.

Temporarily delaying collection

If you are experiencing financial difficulties and cannot pay your financial obligation, you might qualify for a temporary delay in collection by the IRS. This means the IRS will report your account as not collectible until your financial situation improves. Acknowledging that you can not afford the debt does not make it disappear, but it can be a helpful step in managing your financial situation.

To request a delay in collection, you may be asked to complete a Collection Information Statement and provide proof of your financial status, including information about your assets, monthly income, and expenses. It is important to note that during this temporary delay, penalties and interest will continue to accrue until the debt is paid in full.

If the IRS approves your request to delay collection, certain collection actions, such as issuing a levy, may be temporarily suspended until your financial condition improves. However, the IRS may still file a Notice of Federal Tax Lien while your account is suspended. To discuss this option further and determine your eligibility, contact the phone number listed on your bill.

Qualifying for an offer in compromise

Qualifying for an offer in compromise involves meeting certain eligibility criteria set by the IRS. To be considered for an OIC, you must have filed all required tax returns, received a bill for at least one tax debt included in the offer, and made all necessary estimated tax payments for the current year. Business owners with employees should make sure they have made all federal tax deposits for the current quarter and the two previous quarters. It’s important to note that individuals in open bankruptcy proceedings are not eligible for an offer in compromise.

To determine your eligibility and begin the process, you can use the Offer in Compromise Pre-Qualifier tool provided by the IRS. This tool will help you assess if you meet the initial requirements for an OIC. If you believe you qualify, you can submit an offer to settle your taxes owing for a reduced amount. Keep in mind that the IRS will thoroughly review your financial situation before approving an offer in compromise, and you may be required to provide detailed financial information to support your request

Important considerations

You won’t go to jail if you can’t pay

One common fear people have when they owe money to the IRS is that they will end up in jail if they can’t pay their tax bill. However, the truth is that the IRS is not in the business of sending people to jail simply because they can’t afford to pay their taxes.

While it is important to fulfill your tax obligations and work towards resolving any outstanding debt with the IRS, the agency understands that financial hardships can arise. If you find yourself in a situation where you are unable to pay your tax bill, there are options available to help you navigate through this challenging time.

By taking proactive steps, such as filing your income tax return or requesting an extension, you can avoid additional penalties and fees that may accrue if you fail to meet deadlines. Additionally, you can explore payment agreements with the IRS to find a solution that works for your financial situation.

If you can not pay your taxes, it’s vital to know that jail time is not usually a likely outcome. Instead, it’s best to concentrate on understanding your alternatives and collaborating with tax professionals to find a resolution.

The legal obligations and due process rights of the IRS

As a government agency responsible for collecting taxes, the IRS has certain legal obligations and due process rights that must be upheld when dealing with taxpayers. The IRS treats taxpayers courteously and provides them with due process rights, as outlined in the IRS Restructuring and Reform Act of 1998.

One of the key obligations is to communicate with taxpayers clearly and respectfully. Taxpayers can be represented by a tax professional, such as an attorney, CPA, or enrolled agent, during any interactions with the IRS. Taxpayers can request to speak with a supervisor if they feel they are not being treated courteously by an IRS representative during a tax audit.

Additionally, taxpayers have the right to receive notice and an opportunity to be heard before the IRS takes any action to collect unpaid taxes. Taxpayers must give their views and present all relevant evidence before the IRS can initiate enforcement measures.

To ensure their rights are protected, taxpayers are encouraged to seek professional tax help from a tax professional such as a CPA or an enrolled agent. These professionals can help taxpayers understand their audit notices, prepare for interviews with the IRS, and identify any potential red flags on their tax returns that may attract further scrutiny.

Consulting with a tax professional

Consultation with a tax expert can be key in resolving tax disputes with the IRS. Tax professionals, such as certified public accountants (CPAs) or enrolled agents, have the expertise and experience to navigate complex tax laws and regulations. They can provide guidance on the best course of action to take in your specific situation, whether it be setting up a payment plan, negotiating an offer in compromise, or representing you in front of the IRS.

When you’re seeking advice from a tax professional, give them all the relevant information about your tax situation. This includes any notices or correspondence you have received from the IRS, and documentation of your income, expenses, and assets. Being transparent and forthcoming with your tax professional will allow them to assess your situation and provide you with the best possible advice.

Working with a tax specialist can help relieve the stress and burden of managing your tax issues independently. They can communicate with the IRS on your behalf, handle paperwork and documentation, and ensure that all deadlines are met on time.

Taking action to address tax debt

When faced with tax due, it is important to take proactive steps to address the issue and avoid further financial consequences. The IRS offers various payment options and programs to help taxpayers manage their tax liabilities and settle their debts.

Developing a plan to pay off the debt

When faced with back taxes, it’s important to develop a plan to pay off the debt. Start by contacting your plan administrator to inquire about the possibility of taking a loan from your 401(k) plan. This can be a quick and cost-effective way to get the cash you need.

However, be aware of the potential impact on your retirement savings if the loan is not repaid. If a loan is not an option, consider using a debit or credit card to pay off the balance, but be mindful of the fees involved. Remember to explore payment arrangements or offers in compromise with the IRS or state comptroller to resolve your money owing efficiently.

Communicating with the IRS and following their instructions

When communicating with the IRS, it is important to carefully read any letters or notices you receive before reaching out to them for assistance. By following the instructions provided by the IRS and seeking help when needed, taxpayers can effectively address their tax issues and avoid more serious consequences. Remember to use all the resources on IRS.gov for guidance and support in resolving outstanding tax liabilities. By staying proactive and following the IRS’s instructions, taxpayers can navigate the tax collection process more successfully.

Reviewing your financial situation regularly

Review your financial situation regularly is important to ensure you are on track with your tax obligations. By staying informed about your income, expenses, and potential tax liabilities, you can proactively plan for any unexpected bills that may come your way.

Regular financial check-ins with a financial advisor can help you optimize your financial plan and potentially reduce your tax liability. Stay on top of your finances to avoid surprises, and make sure you are prepared for tax time.

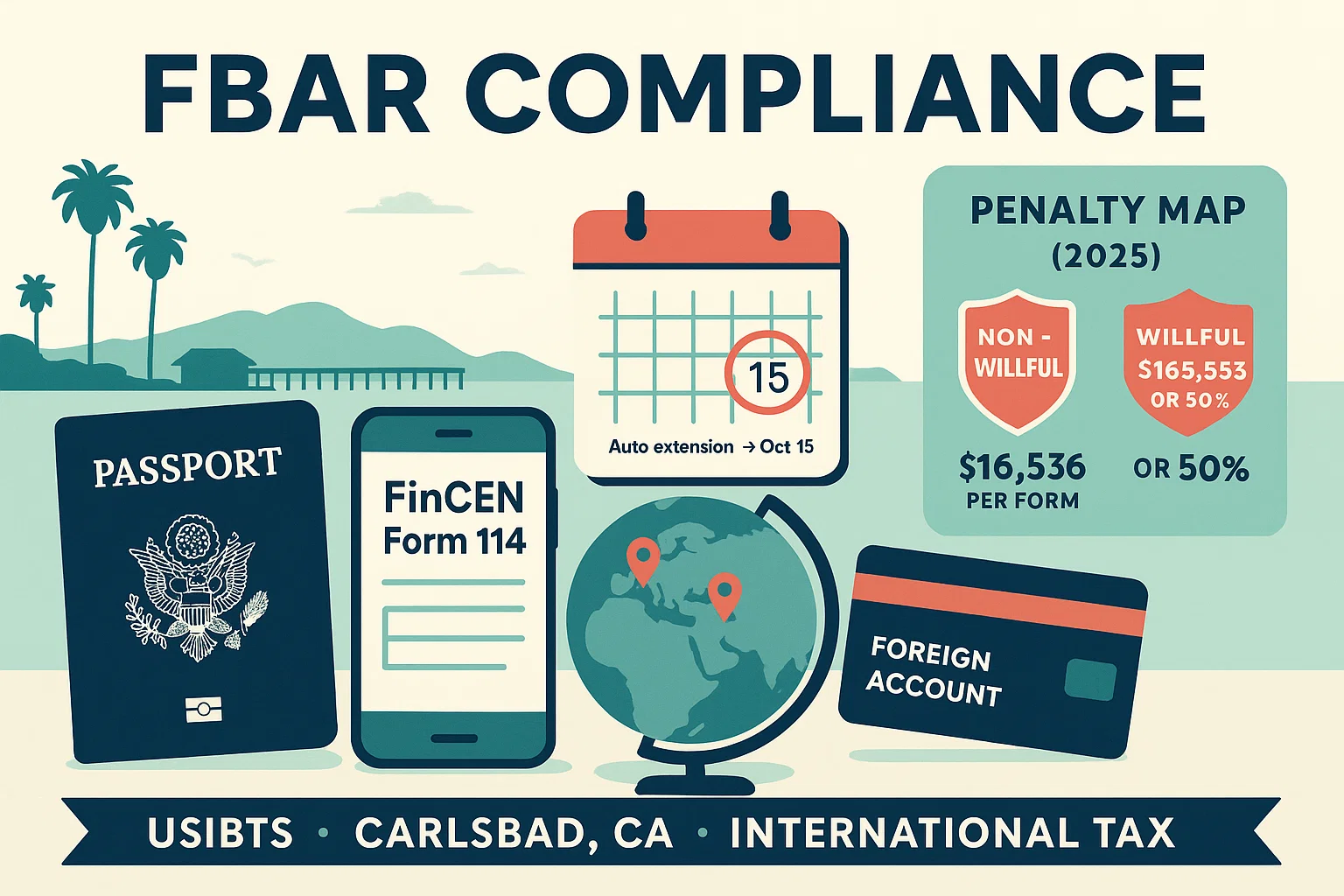

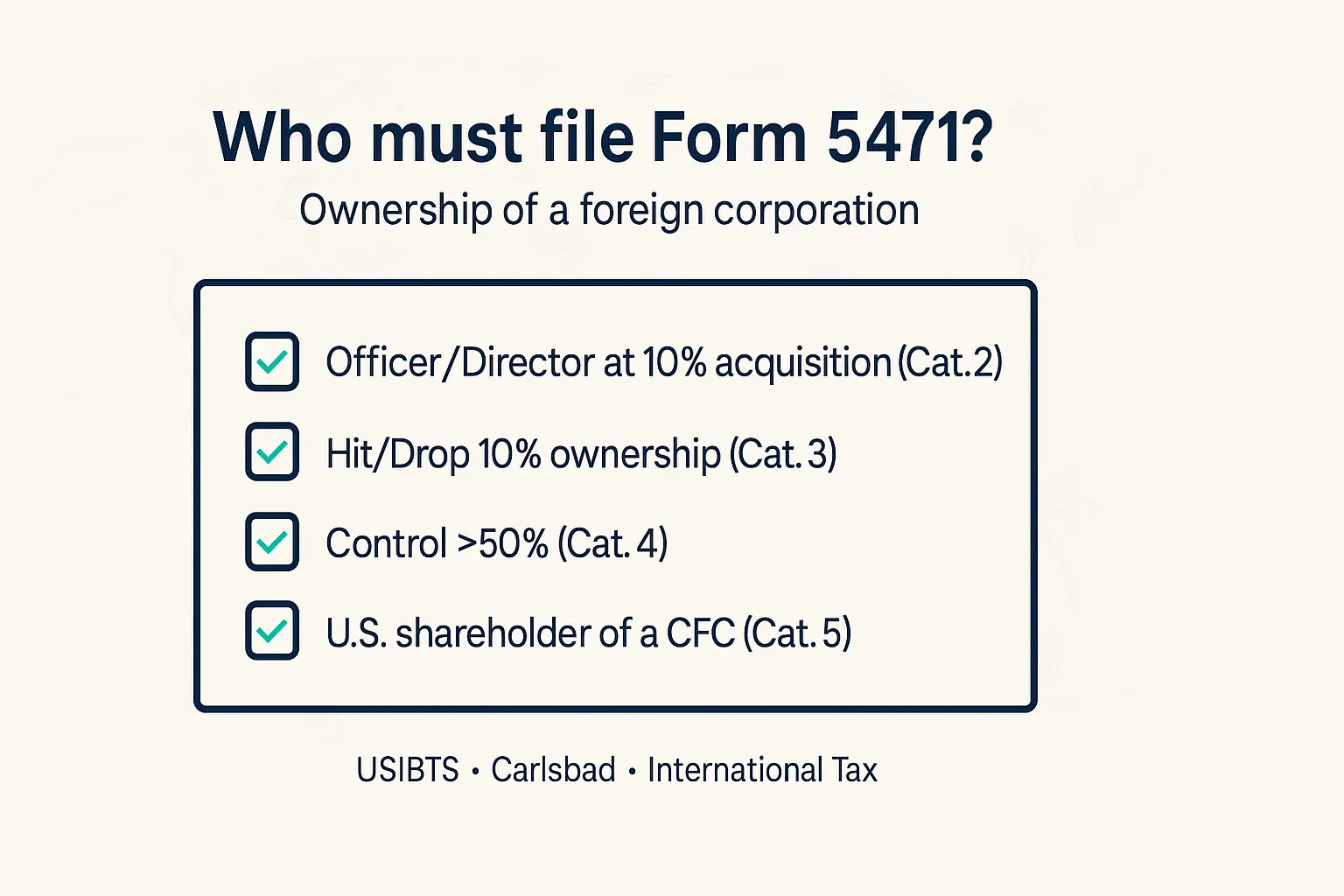

Schedule Tax Consultation with USiBTS in Carlsbad, CA

Our experienced tax professionals are dedicated to helping taxpayers like you find the best solutions for your tax problems. During your tax consultation, our team will work with you to assess your situation and explore the available options.

We understand that dealing with the IRS can be overwhelming. With the support of USiBTS, you can feel confident knowing that you have a knowledgeable and experienced team on your side. Schedule a tax consultation with us today and take the first step towards your tax problems.

Share this post :

Categories