Blog

Permanent Establishment Risk: What Triggers Foreign Tax Exposure?

Permanent Establishment Risk: What Triggers Foreign Tax Exposure?If your San Diego-area business is testing new markets in Mexico, Europe, or Asia,

Optimizing Cross-Border Withholding on U.S. Dividends and Interest

If your San Diego–based company pays dividends or interest to foreign investors, the default 30% U.S. withholding under IRC §§1441/1442 can be

Form 8938 (FATCA): Avoiding Common Mistakes

If you live in San Diego County and hold assets overseas, Form 8938 (FATCA) is easy to get wrong, and ignoring it can be costly. Below are the

How to Report Foreign Rental Property on Your U.S. Tax Return

Own a condo in Baja, a flat in London, or an apartment in Tel Aviv but file taxes in San Diego County? The IRS expects you to report worldwide rental

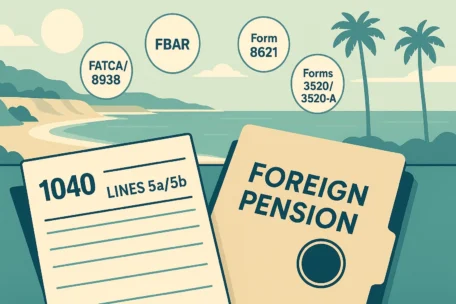

Reporting Foreign Pensions: What the IRS Wants to See

If you’re a U.S. citizen, green-card holder, or long-term resident in Carlsbad, San Diego, or anywhere in U.S., the IRS expects you to report

Foreign-Owned U.S. LLC? Why You May Need to File Form 5472

If you’re a foreign investor who formed a U.S single-member LLC treated as a disregarded entity, there’s a good chance the IRS expects an annual