International Tax Preparation with USiBTS

Looking for reliable international tax specialists in California? Look no further than USiBTS.

We are a distinguished firm specializing in international taxation and tax planning for corporations, LLCs, and Partnerships with foreign shareholders, partners, and foreign individual or corporate investors. Our seasoned tax specialists have extensive knowledge and expertise in navigating the intricacies of tax laws.

We understand that navigating the complex web of international tax laws can be daunting. Hence, we are dedicated to providing our clients with top-tier services that alleviate any tax-related concerns. Our international tax specialists in Carlsbad are well-versed in preparing even the most complex tax forms, including:

- Foreign partner tax withholding for U.S. partnership - Form 8813, Form 8805, Form 8804

- Foreign and U.S-based business entity classification - Form 8832

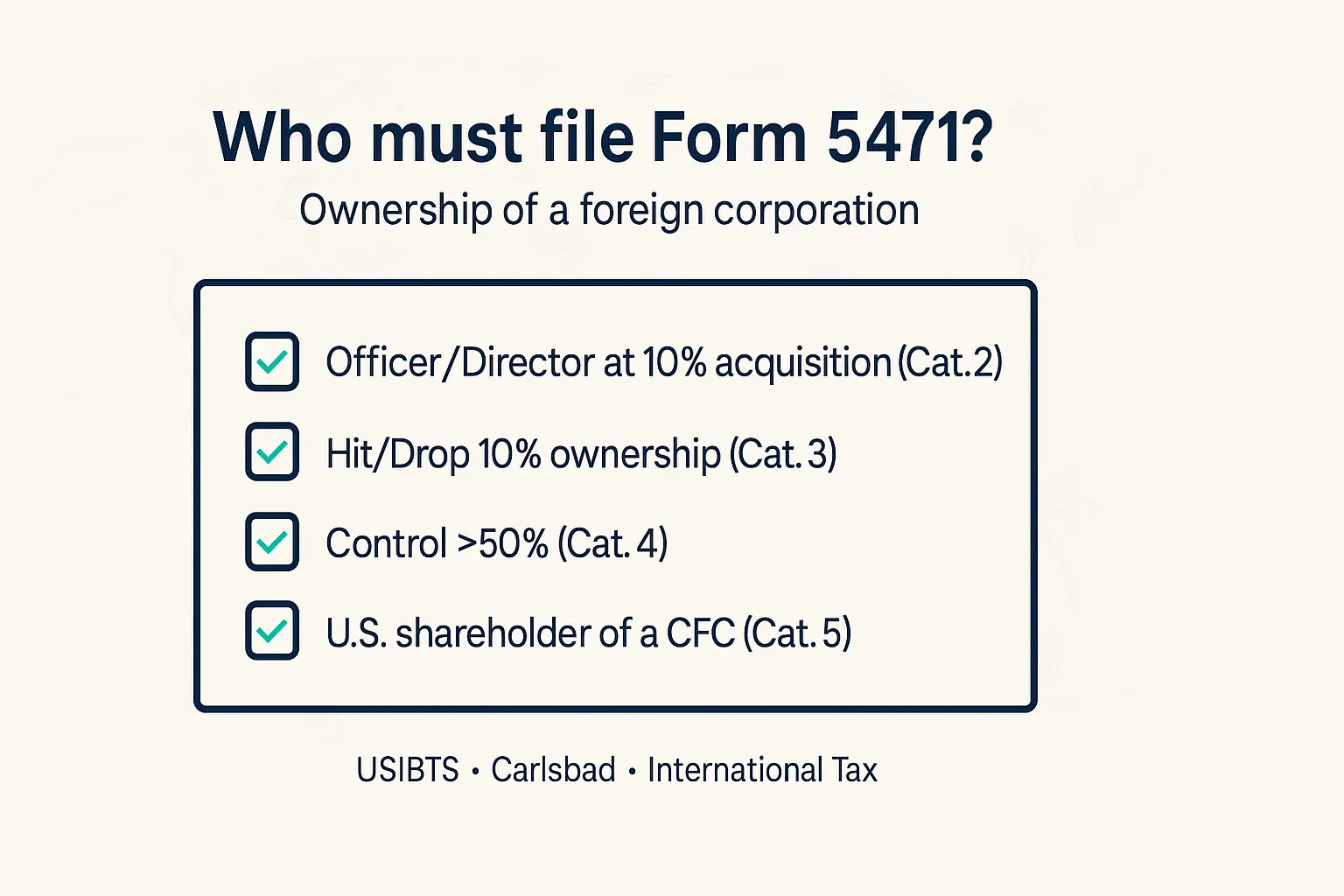

- U.S. shareholders and partners of foreign entities - Form 5471 and Form 8865

- U.S. non-resident withholding tax requirements - Form 1042 and 1042-S

- U.S. corporation with foreign shareholders - Form 5472

- U.S. tax return preparation for non-resident individuals working in the U.S. - Form 1040NR

- U.S. tax return preparation for non-resident individuals working in the U.S. remotely - Form W-8 BEN

- Foreign assets and account reporting and compliance - Form 8839, Form 3520, FinCen114

- U.S. Persons With Respect to Foreign Disregarded Entities and Foreign Branches - Form 8858

- Tax amnesty program consulting and preparation - Streamlined Filing Compliance Procedures

- Tax treaty analysis

- Foreign tax credits

- FDII deductions

At USiBTS, we take a proactive approach toward tax planning and compliance for U.S. companies and individual investors conducting business internationally. Our services extend beyond mere consultancy on international tax inquiries and day-to-day transactions. We provide clients with comprehensive guidance on tax returns, audit representations, and other related areas.

We value the trust our clients place in us and take our responsibility towards them seriously. Our team is committed to establishing and maintaining lifelong bonds and partnerships with our clients. We are confident that by choosing USiBTS, you have taken a step toward success. Allow us to assist you in optimizing your business and leveraging our expertise to help you grow.

Contact us today for international tax preparation services in Carlsbad.

Frequently Asked Questions

Obtain valid W-8 forms, confirm treaty eligibility (including limitation-on-benefits tests), and apply reduced rates at source. For interest, check if the Portfolio Interest Exemption applies. Then deposit tax and file Forms 1042/1042-S accurately. Remember: the “withholding agent” (including paying agents/intermediaries) is responsible and can be liable for tax, penalties, and interest if withholding/reporting is missed.

- You’re a U.S. citizen, Green Card holder, or tax resident

- You meet the IRS’s non-residency test for the Streamlined program

- Your failure to report was non-willful, caused by a misunderstanding or oversight

- You’re not currently under IRS audit or investigation

SFOP allows to file late returns and FBARs without penalties. Consult USIBTS to see if you qualify.

U.S. citizen or lawful permanent resident residing in the U.S. who timely filed U.S. tax returns for the last three years, had an unintentional (non willful) failure to report foreign assets/income, and is not under IRS audit or criminal investigation.

Likely yes. Foreign-owned U.S. disregarded entities must file Form 5472 (attached to a pro forma Form 1120) for reportable transactions with related parties, and for SMLLCs that includes capital contributions and distributions, with no de minimis threshold. Penalties for late/incomplete filing start at $25,000 and can increase if not corrected.

Maybe. If your pension involves a foreign financial account and your aggregate foreign accounts exceeded $10,000, you likely need FBAR. If your interest in the plan (or other specified foreign financial assets) exceeds FATCA thresholds, Form 8938 may apply. Some plans are treated as foreign trusts (Forms 3520/3520-A), but Rev. Proc. 2020-17 exempts many tax-favored foreign retirement trusts. Always report distributions on Form 1040, lines 5a/5b, and confirm the right mix of forms with an international tax CPA.

You likely don’t owe taxes, but you are required to report it. U.S. taxpayers must file Form 3520 if they receive more than $100,000 in gifts or inheritances from foreign individuals or estates in a calendar year. Failure to file can result in steep penalties, even if no tax is due.

Navigating the complexities of tax regulations in different countries can be challenging. International tax preparation services help you optimize your tax liability, take advantage of available tax credits, and ensure compliance with diverse tax laws, ultimately saving you time and money.

Yes, our international tax preparation services include specialized assistance for expatriates. We can guide you through the unique tax considerations and obligations that come with living and working abroad, ensuring compliance with both your home country and the host country's tax laws.

Our Blog

See moreFROM OUR BLOG

Got shares in a foreign company? Here’s how to know if Form 5471 is on your to-do list.

August 12, 2025

Read More

Streamlined Domestic Offshore Procedures: Fixing Past Foreign Reporting Failures

July 29, 2025

Read More

Streamlined Foreign Offshore Procedures: Fixing Past Foreign Reporting Failures

August 5, 2025

Read More

How to Avoid Double Taxation on Your Foreign Income: A Simple Guide for Carlsbad, CA Residents

August 15, 2023

Read More